Has Your Newly Built Home Increased in Value? You Could Save on Your Loan

If your house has just finished building, there’s a chance you’ve already paid Lender’s Mortgage Insurance (LMI) and locked in a high interest rate. But here’s something many homeowners don’t realise — your property’s value has likely increased since you first took out your loan.

When this happens, your loan-to-value ratio (LVR) drops.

What is LVR?

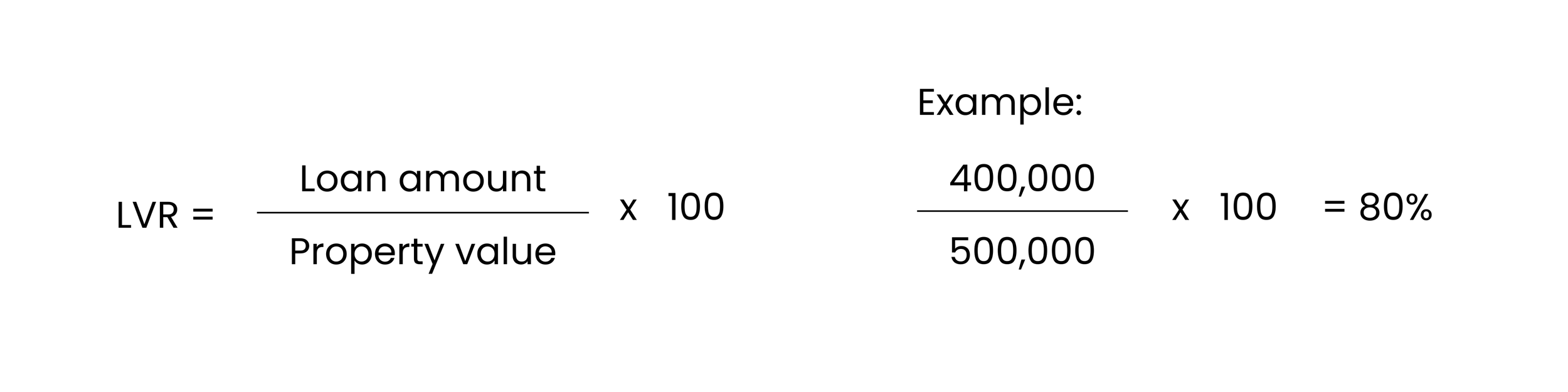

Your LVR is a simple way to measure the size of your loan compared to the value of your home. It’s calculated like this:

For example, if you borrowed $400,000 to buy a home that’s now worth $500,000, your LVR is 80%. A lower LVR means you owe less compared to what your home is worth. Banks see this as less risky, which often leads to better interest rates.

If you think this is you, let us review your loan as you could be in line for a big rate discount.